Tax Year Vs Calendar Year – Because individuals must use a calendar year in filing their taxes, your business will effectively have to use a calendar year as well. Even if you use a business entity like a partnership . is the time frame for keeping together records of expenses and income — information you enter into your annual tax return to calculate taxable income. Individuals typically use a calendar year. .

Tax Year Vs Calendar Year

Source : www.thebalancemoney.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

Fiscal Year vs Calendar Year | Top 8 Differences You Must Know!

Source : www.wallstreetmojo.com

What Is the Tax Year? Definition, When It Ends, and Types

Source : www.investopedia.com

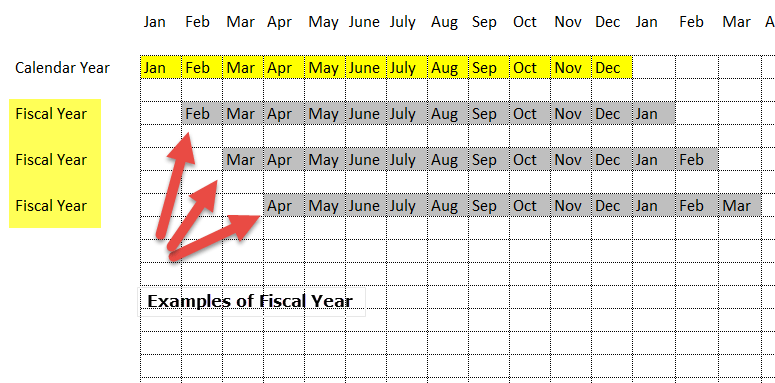

Fiscal Year vs Calendar Year | Top 8 Differences You Must Know!

Source : www.wallstreetmojo.com

What Is Fiscal Year End? Definition and vs. Calendar Year End

Source : www.investopedia.com

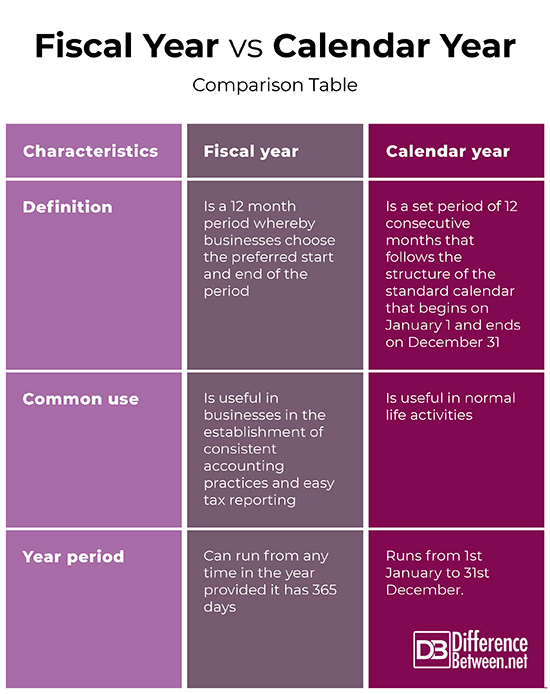

Calendar Year vs Fiscal Year | Top 6 Differences You Should Know

Source : www.educba.com

Difference Between Fiscal Year and Calendar Year | Difference Between

Source : www.differencebetween.net

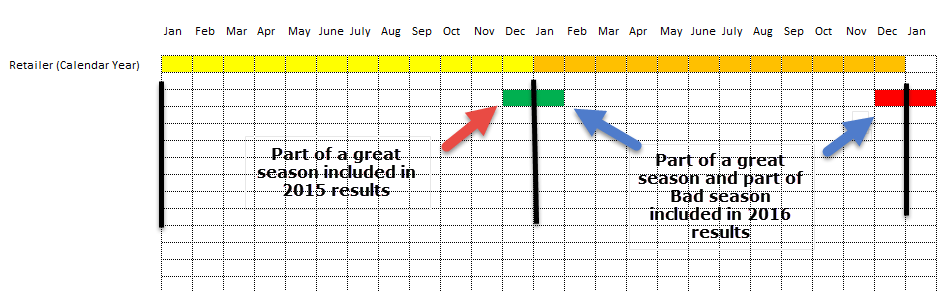

Fiscal Year vs. Calendar Year: Key Differences | by Blogwaly | Medium

Source : medium.com

Fiscal Year Definition for Business Bookkeeping

Source : www.beginner-bookkeeping.com

Tax Year Vs Calendar Year What Is a Fiscal Year?: Business finance company signs. Fiscal year vector icons. Business finance company signs. Editable stroke. Financial reporting budgeting statement revenue. Calendar accounting external audit tax. . In general, the following guidelines apply: F-1 and J-1 students are considered nonresidents for tax purposes during their first five calendar years of study. A calendar year runs from January 1 to .

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)

:max_bytes(150000):strip_icc()/taxyear-c3f5618cd504499583b0543cb4d6b31e.jpg)

:max_bytes(150000):strip_icc()/FiscalYear-End_v1-e3337960a07c4b9f9a9d394e934caca2.jpg)